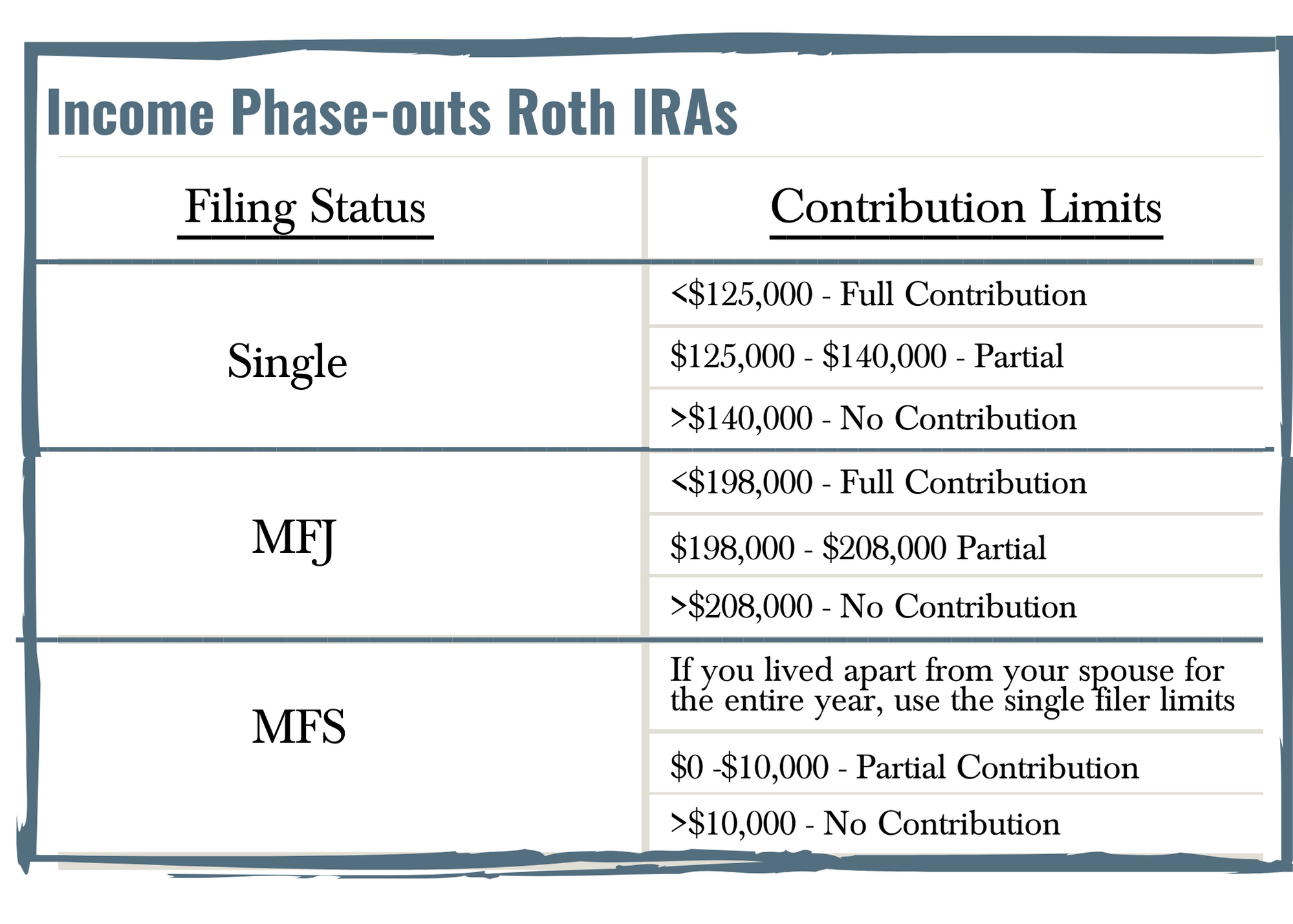

Roth Contribution Limits 2025 Agi 2025. Ira contributions after age 70½. In 2025, you can contribute a total of up to $7,000, or $8,000 if you’re age 50 or older, to all of your roth and traditional ira accounts.

Roth Ira Limits 2025 Agi 2025 Inez Consuela, The maximum amount you can contribute to a roth ira for 2025 and 2025 is $7,000 if you're younger than age 50.

2025 Roth Ira Agi Limits Nari Tamiko, Roth ira contribution limits (tax year 2025) investment and insurance products are:

Roth Agi Limits 2025 Ann Amelina, Not fdic insured • not insured by any federal government agency • not a deposit or other obligation.

Roth Ira Limits 2025 Agi Vonny, In 2025, the max ira contribution you’re able to make is $7,000.

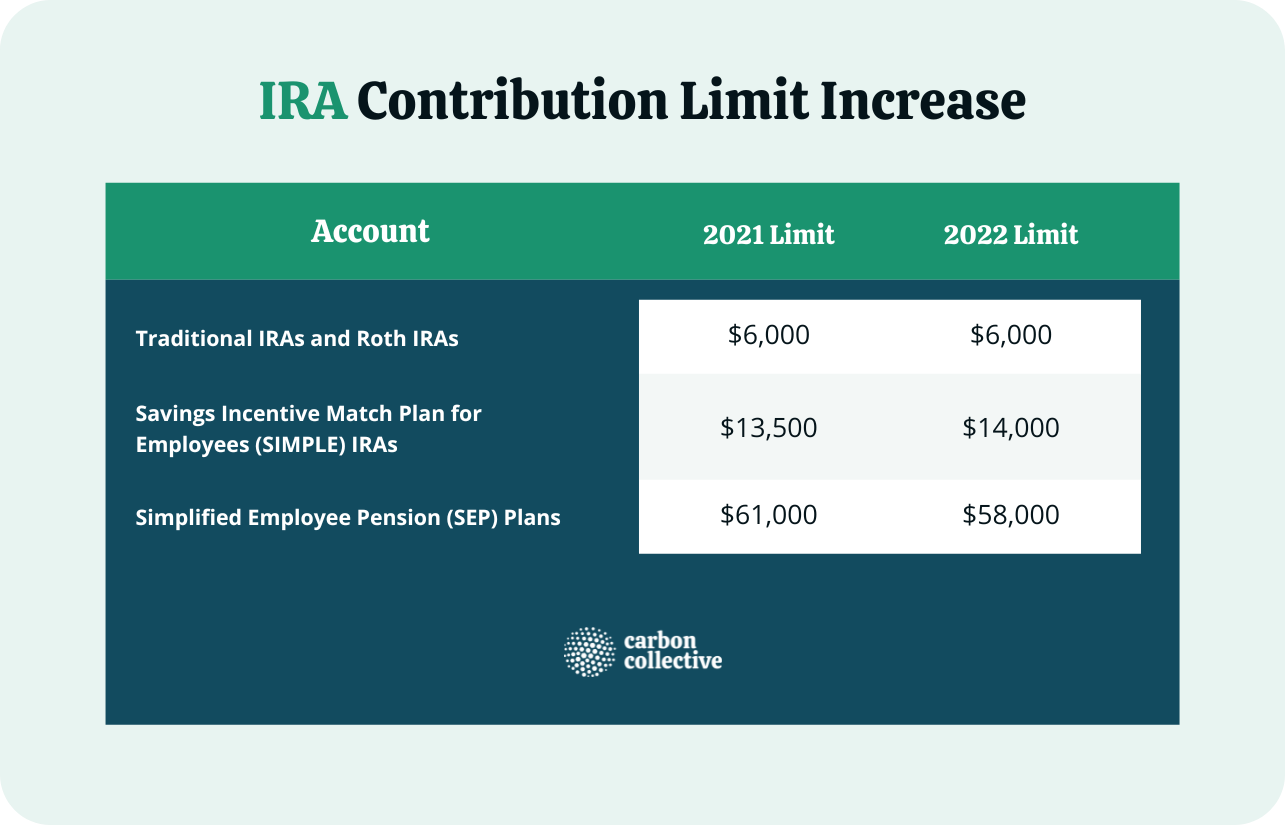

Roth Ira Limits 2025 Agi 2025 Addy Winnifred, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 and 2025 tax years is $7,000 or $8,000 if you are age 50 or older.

Roth 2025 Contribution Limit Irs Teena Atlanta, In 2025, you can contribute a total of up to $7,000, or $8,000 if you’re age 50 or older, to all of your roth and traditional ira accounts.

Roth Ira Limits 2025 Agi 2025 Shea Yettie, The maximum amount you can contribute to a roth ira for 2025 and 2025 is $7,000 if you're younger than age 50.

Ira Roth Contribution Limits 2025 Cyndi Rebecca, The roth ira income limits will increase in 2025.

Roth Ira Limits 2025 Agi 2025 Shea Yettie, Review a table to determine if your modified adjusted gross income (agi) affects the amount of your deduction from your ira.