401k Total Contribution Limits 2025. This amount is up modestly from 2025, when the individual 401. For 401 (k), 403 (b), most 457's, and the federal government's thrift savings plan (tsp), the limit has been increased to $23,000, up from $22,500 in 2025.

In 2025, people under 50 can typically contribute up to $23,000 to their 401(k) plans for the year. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50.

For 401 (k), 403 (b), most 457's, and the federal government's thrift savings plan (tsp), the limit has been increased to $23,000, up from $22,500 in 2025.

401(k) Contribution Limits in 2025 Meld Financial, 401 (k) pretax limit increases to $23,000. You can contribute up to $7,000 to traditional.

401(k) Contribution Limits for 2025, 2025, and Prior Years, Employer matches don’t count toward this limit and can be quite generous. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

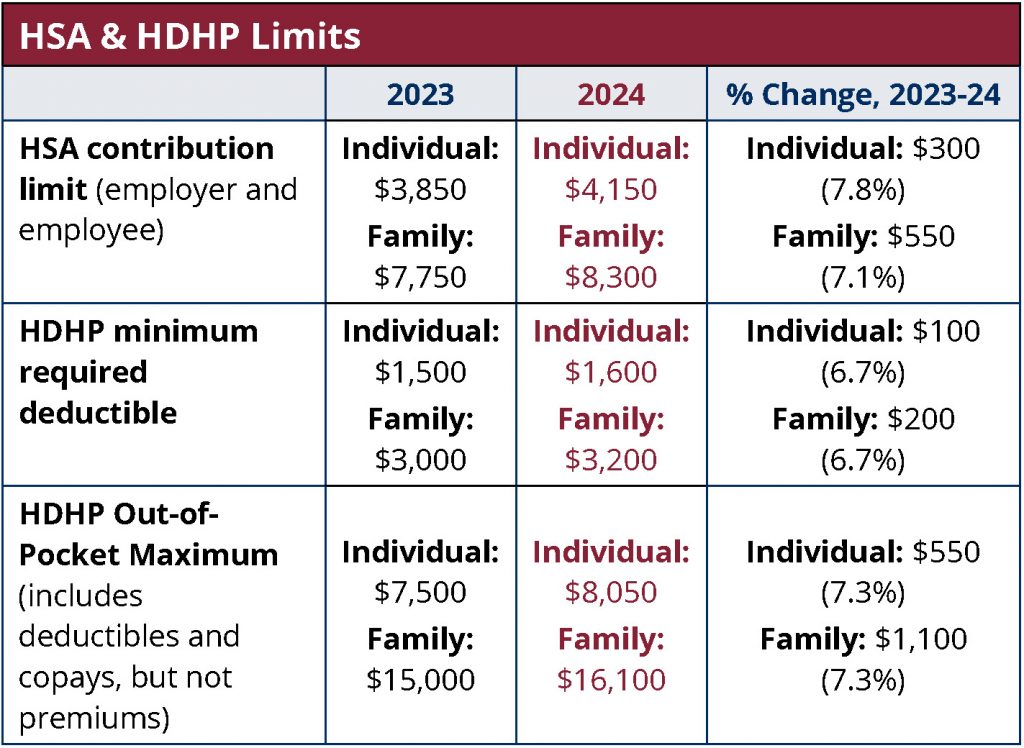

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, 401 (k) pretax limit increases to $23,000. If you are 50 or.

401k 2025 Contribution Limit Chart, The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025). 2025 contribution limits for 2025, you can contribute up to $22,500.

Historical 401k Contribution Limits Employer Profit Sharing Is Significant, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. These were announced by the irs on november 1, 2025.

401(k) Contribution Limits & How to Max Out the BP Employee Savings, Highlights of changes for 2025. People 50 and over can contribute an extra $7,500 to their 401 (k) plan in 2025 and 2025.

Infographics IRS Announces Revised Contribution Limits for 401(k), This amount is up modestly from 2025, when the individual 401. For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 401 (k) 2025 limit of $22,500.

The IRS just announced the 2025 401(k) and IRA contribution limits, Plan participants can contribute up to $23,000 to a 401(k) plan for 2025. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Solo 401k Contribution Limits for 2025 and 2025, Those 50 and above have. Highlights of changes for 2025.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, Those 50 and above have. Highlights of changes for 2025.

For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 401 (k) 2025 limit of $22,500.